'Older And Wiser Now Means Being Richer' — Baby Boomers Own 72% Of Nation's Wealth, But Gen X And The Younger Generations Trail Far Behind

The economic divide between generations is becoming increasingly pronounced, with older Americans amassing a significant portion of the nation’s wealth. A Fox News video titled "Baby Boomers' Wealth Bursts As Gen X and Younger Lag Behind" opens with the observation that “being older and wiser now means richer.”

This report reveals that Americans older than 55 control 72% of the nation’s wealth, highlighting a major contrast with the financial realities facing those younger than 55, who see little to no growth in their financial assets. This wealth concentration among older generations raises important questions about economic equity and the financial prospects of younger Americans.

According to the video, a Fox News poll highlighted a shift in political allegiance among voters younger than 30, showing former President Donald Trump leading President Joe Biden by 13 points in this demographic. The economy emerges as a major concern for these voters, who seem to adopt a different perspective toward the presidency and, by extension, their economic future.

The report elucidates the generational wealth divide: Americans 70 and older own 30% of the nation’s wealth, while those between 55 to 65 control 42%. In contrast, households aged 40 to 54 hold 20% of the wealth, and those younger than 40 possess less than 7%. This disparity is not merely a reflection of current economic conditions but also the result of decades-long trends in stock investment and home ownership that have favored older Americans.

Younger Americans face myriad economic challenges, including high college costs, rising interest rates and soaring housing prices. Unlike their predecessors, who navigated through six recessions and faced mortgage rates as high as 18%, younger generations have not had the same opportunities to build wealth through home ownership or stock market investments.

The conversation around this wealth gap also touches on changing attitudes toward work and savings. For instance, younger generations’ spending habits, characterized by daily indulgences such as $7 Starbucks coffees and frequent online purchases, contrast with the financial prudence historically practiced by older generations.

It's not just the millennials and Gen Z struggling to save. The New York Post reports that the more than 65 million Americans in Generation X, ranging in age from 43 to 58, face the largest wealth gap of any generation. This exacerbates the challenges highlighted by Schroders’ 2023 U.S. Retirement Survey. According to the survey, Gen Xers anticipate needing over $1.1 million for retirement but expect to have only $660,000 by the age of 67. This projection leaves them $440,000 short of their desired retirement savings and a significant $1 million less than what the average adult in this generation currently has saved. The National Institute on Retirement Security (NIRS) found that the average Gen X household has even less set aside for retirement, with savings amounting to just $40,000.

This generational wealth disparity, coupled with evolving economic and social attitudes, underscores the complex interplay between age, wealth and political preferences in the United States. As the country navigates these changing dynamics, the impact on electoral outcomes and broader economic policies remains a subject of keen interest and debate.

Consulting a financial advisor is not just beneficial; it’s a strategic move for anyone looking to navigate the complexities of today’s economy. Whether you’re trying to build your wealth from scratch or manage an existing portfolio, a financial adviser can provide the guidance needed to make informed decisions. This step is crucial for younger generations facing economic challenges and equally important for those in higher wealth brackets aiming to preserve and enhance their assets. In essence, seeking financial advice is a proactive step toward achieving financial stability and growth, regardless of your economic standing.

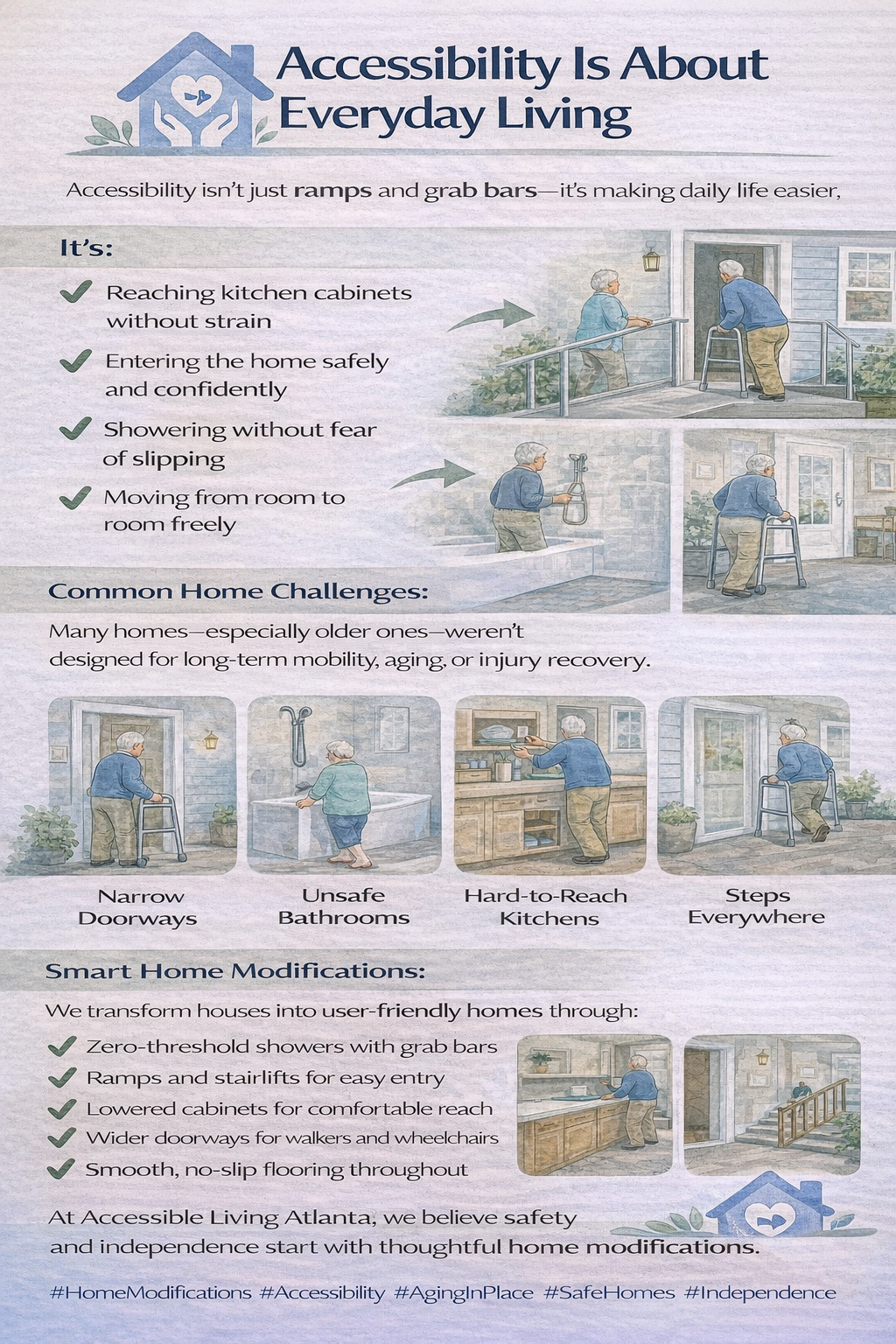

#homeaccessibility #homemodification #homehealthcare #aginginplace #aginggracefully #caregivers #disability #disabilityawareness #wheelchairuser #wheelchairaccessible #spinalcordinjury #physicallychallenged #safetyathome #elderlycare #graytsunami #healthylifestyle #accessiblematters #userfriendlyhome